About Us

Our Vision

To be the most trusted Fund Manager in Samoa for wealth creation

Our Mission

To provide unitholders with a preferred digitally secured investment opportunity for a better financial future

Welcome to UTOS

The Unit Trust of Samoa (UTOS) is an initiative of the Government of Samoa, whose primary goal is to provide an affordable and accessible investment vehicle for local and overseas-based Samoans. This is to allow participation, not only in Samoa’s future developments but also in allowing them to access large-scale investment opportunities in privately owned companies.

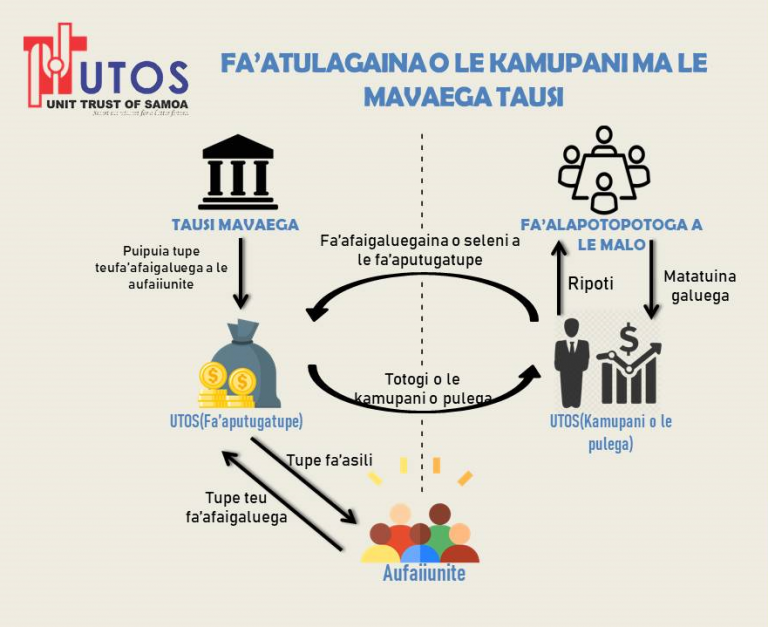

The Minister of Finance approved the establishment of the Trust on 2nd March 2009 as required by Section 3 of the Unit Trusts Act 2008. However, the Trust did not become operational until the Trust Deed was signed on 9th July 2010 between Unit Trust of Samoa (Management) Ltd and UTOS (Trust) by and through a Trustee Company. The relationship between the Manager and the Trustee are set out in the UTOS Trust Deed dated 9th July 2010 and subsequent amendments. UTOS must at all times be operated in accordance with the Trust Deed.

UTOS provides an opportunity for small investors to access a range of investments while at the same time spreading risks and leaving the management of their funds in the hands of experts.

The Manager

As per the Unit Trust Act 2008, there must be a Manager for the Unit Trust. The Manager for UTOS is a State Owned Enterprise known as the Unit Trust of Samoa (Management) Limited (‘UTOSM’) and is a registered company under the Companies Act and the Public Bodies Act. The Manager shall have vested in it the powers of management of the investments and other property that are subject to the trusts governing the unit trust. The Manager also offers the units in UTOS for sale to the general public. The Manager comprises a team of individuals with experience in investment and financial analysis required for making investment decisions, under the guidance of the Board of Directors.

The Trustee

The Unit Trust Act 2008 also stipulates that the Unit Trust must have a Trustee. The current Trustee is Tafailagi Trustee Company Ltd. The Trustee is responsible for ensuring that the Manager acts in the best interests of Unitholders and holds the legal title to all of the Trust’s assets.

Interested investors should read this Prospectus and the Trust Deed carefully to see whether investing in UTOS is appropriate for them. There are risks involved and buying units in the Trust will not suit everyone or all businesses.

How does UTOS work?

You and others purchase units in the Trust and become “Unitholders”. To qualify as a Unitholder, you must hold at least 25 units at all times. There is no limit to how many more units you may buy and keep. Unitholders are issued with a Unit Certificate that shows the number of units that they have purchased.

Unitholders must be of Samoan descent or permanent residents. Unitholders can be individuals, families, businesses, associations, or organizations such as church groups, women’s committees, and sports clubs. All new Unitholders must complete an application form and provide all supporting documentation and information to the Manager to assess their application. If all legal and regulatory requirements to become a Unitholder are satisfied, the application is approved and units are issued to the Unitholder. If the application is declined, all monies paid for units are returned to the applicant and no units are issued.

Once a Unitholder is issued units, his or her money is combined with that of other Unitholders. The Manager of UTOS then decides how that money should be invested for the benefit of all Unitholders.

The Trustee is the legal owner of the Trust’s funds and assets. Provided that they are acting in the best interests of Unitholders, the Trustee and the Manager have the power to do whatever is needed to manage the Trust’s funds and assets effectively.

A Unitholder cannot instruct the Trustee or the Manager to manage the Trust’s investments in a particular way, for example, to sell or buy a particular asset. Those decisions are left to the Manager under the supervision of the Trustee. Once the Manager makes the decision on when and where to invest Trust funds, the Trustee will endorse this decision subject to the Manager complying with the Investment Policy, Central Bank of Samoa Prudential Guidelines for Unit Trusts, and other relevant regulatory restrictions.

The price of each unit (“Unit Price”) in the Trust is reviewed on a monthly basis with a unit price notice issued on the first Wednesday of each month. However, the Manager reserves the right to change the price at any time when the Manager is aware of a transaction that will significantly impact the price and this instant review is required to mitigate any insider trading based on the available information. The Unit Price is calculated using the net asset value of the Trust. The unit price is published on our website and social media pages.

All profits generated from the investment portfolio are made available for distribution to Unitholders. The Manager and Trustee will decide how much of this profit will be distributed as dividends to Unitholders, and when to pay it out.

The Trust is structured as an open-ended private unit trust. The units issued or offered to investors represent their share in the total net assets of the Trust. Units offered are not categorized thus, each unit issued or offered carries the same interest and treatment as all other units issued or offered by the Trust.

Our Team

Tafa’ilagi Trustee Co Ltd

Taito John Michael Roache (Trustee)

Luana Olga Eugenie Von Reiche Roache (Trustee)

Board of Directors

Tufeao Faatuai Pulepule Fanolua

Seulupe Michelle Macdonald

Lemalu Patricia Ah Chong-Fruean

Salote Peteru

Chief Executive Officer

Malaeulu Aysha Rimoni

UTOS Trust

Ah Chong Public Accountants

UTOS Management Ltd

Audit Office